Table Of Content

In the early stages of the home buying process, lenders will typically request credit reports, usually utilizing the three main reporting agencies to establish your creditworthiness for a fee. It’s also worth poring over your Closing Disclosure form provided by your lender to scope out what fees and services your lender is insisting you pay. This tax will vary depending on the project at hand and where you live.

Loan amount

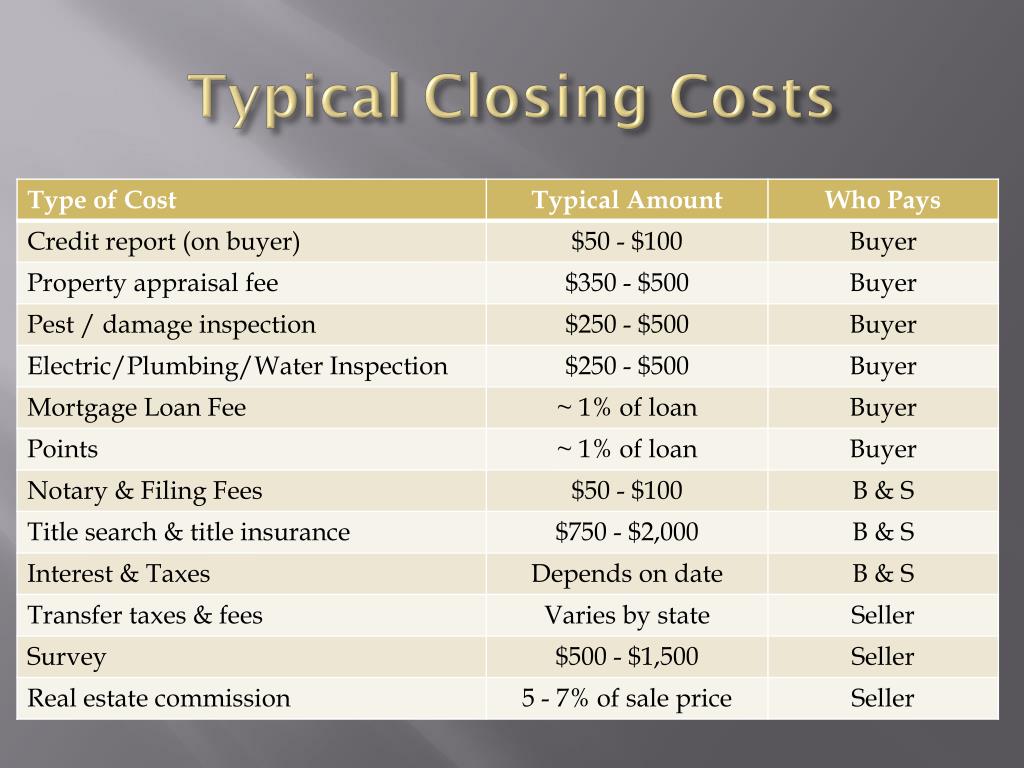

Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and other costs. Some depend on the state in which you’re buying your home, others on the county. Some are related to your lender and the type of mortgage you’re getting, and some have to do with the real estate professionals who are helping you get your deal done. In all, closing costs are a messy amalgam of variable fees.

Questions to ask a real estate agent

However, if you choose not to pay closing costs upfront, you’ll pay more in interest over time. Instead of rolling those costs into your mortgage, you can see if the seller is willing to pay a portion of the closing costs to reduce your upfront expenses. Are you interested in seeing what you can expect to pay in closing costs in your area?

What’s Included in California Closing Costs?

This is a fee charged by the lender for guaranteeing you a certain interest rate (locking in) for a limited period of time, typically from the time you receive a pre-approval until closing. It can run from 0.25% to 0.5% of your loan value, though some lenders offer a rate lock for free. A mortgage calculator can show you the impact of different rates on your monthly payment. Also known as an escrow fee, this is paid to the party who handles the closing, which could be the title company, an escrow company, or an attorney, depending on state law. This independent third party collects all closing costs and distributes proceeds to the appropriate parties involved in the real estate transaction. In some cases, this may be a fixed base fee in addition to a percentage of the loan value.

Remember that some areas of the country have higher closing costs than others. As you shop around, ask lenders to outline the fees they charge and try negotiating them down whenever possible. At closing, expect to pay any pro rata property taxes that are due from the date of closing to the end of the tax year. Similar to interest, the prorated amount will be set based on an anticipated closing date. Should this date get pushed back, the amount of property taxes assessed will change. Points or discount points refer to an optional, upfront payment to the lender to reduce the interest rate on your loan and thereby lower your monthly payment.

Year Jumbo Refinance Interest Rates

Here are a few tips you can use to potentially decrease the amount you’ll pay at closing. Transfer taxes go to your local government in exchange for updating your home’s title and transferring it to you. Like most local taxes, this fee will vary depending on where you live. In some states, you must get a land survey before you can complete a home sale. A survey fee goes to the survey company that verifies and confirms your property lines before you close on the house.

Closing Costs In Minnesota: Who Pays For What? - Bankrate.com

Closing Costs In Minnesota: Who Pays For What?.

Posted: Fri, 29 Sep 2023 07:00:00 GMT [source]

Homeowners Association Fees

From the minute I applied for my bank statement only mortgage to the day I closed Joelle and Me'me have gone above and beyond to make this happen. They never missed a call anytime I had a question or concern. I will continue to recommend this company to everybody I know in search of a mortgage that expects a pain free, professional experience. From the minute I applied for my bank statement only mortgage to the day I closed Joelle and Sheenaqua have gone above and beyond to make this happen. If the home inspection doesn’t go so well, you might be able to negotiate a lower selling price. If there are red flags that are concerning, you also have the option to back out of your contract or you can work with the seller on an agreement to fix the reported issues.

Courier Fee

The documents reflect the sale agreement and allow the parties to verify their interests. Keep in mind, these figures are based on a homebuyer applying a 20 percent down payment, which eliminates the need for private mortgage insurance. Other state-specific expenses, like earthquake insurance, hiring a surveyor or obtaining flood certification aren’t included in this estimate.

C. Services You Can Shop For

Underwriting is the research process of verifying your financial, income, employment, and credit information for final loan approval. This is a fee charged to a certified flood inspector to determine whether the property is in a flood zone, which requires flood insurance. Keep in mind that this is separate from your homeowner's insurance policy. Part of the fee includes ongoing observation to monitor changes in the property’s flood status. A credit report fee is a charge from a lender to pull your credit reports from the three main reporting bureaus.

The monthly payment will include both interest and principal if you are using a conventional, amortizing mortgage. Below we highlight a quick overview of the real estate closing costs buyers pay in Los Angeles so you can be ready to buy. It’s also worth noting that the minimum credit score requirements from Zillow Home Loans are a bit stricter than what some other lenders may require. You need at least a 620 FICO Score to qualify for most loans from the online lender.

For an investment property, the maximum amount of seller concessions for any down payment is 2%. The limits on seller concessions for conventional loans can depend on a few different factors, including whether the property is a primary residence or second home. Government recording fees are charged by the local government (usually the county) for making a public record of the sale. The fee varies depending on location, but will probably be less than $200. That’s a fairly brisk pace of price rises, which may encourage Federal Reserve policymakers to hold off from lowering interest rates until later this year.

No comments:

Post a Comment