Table Of Content

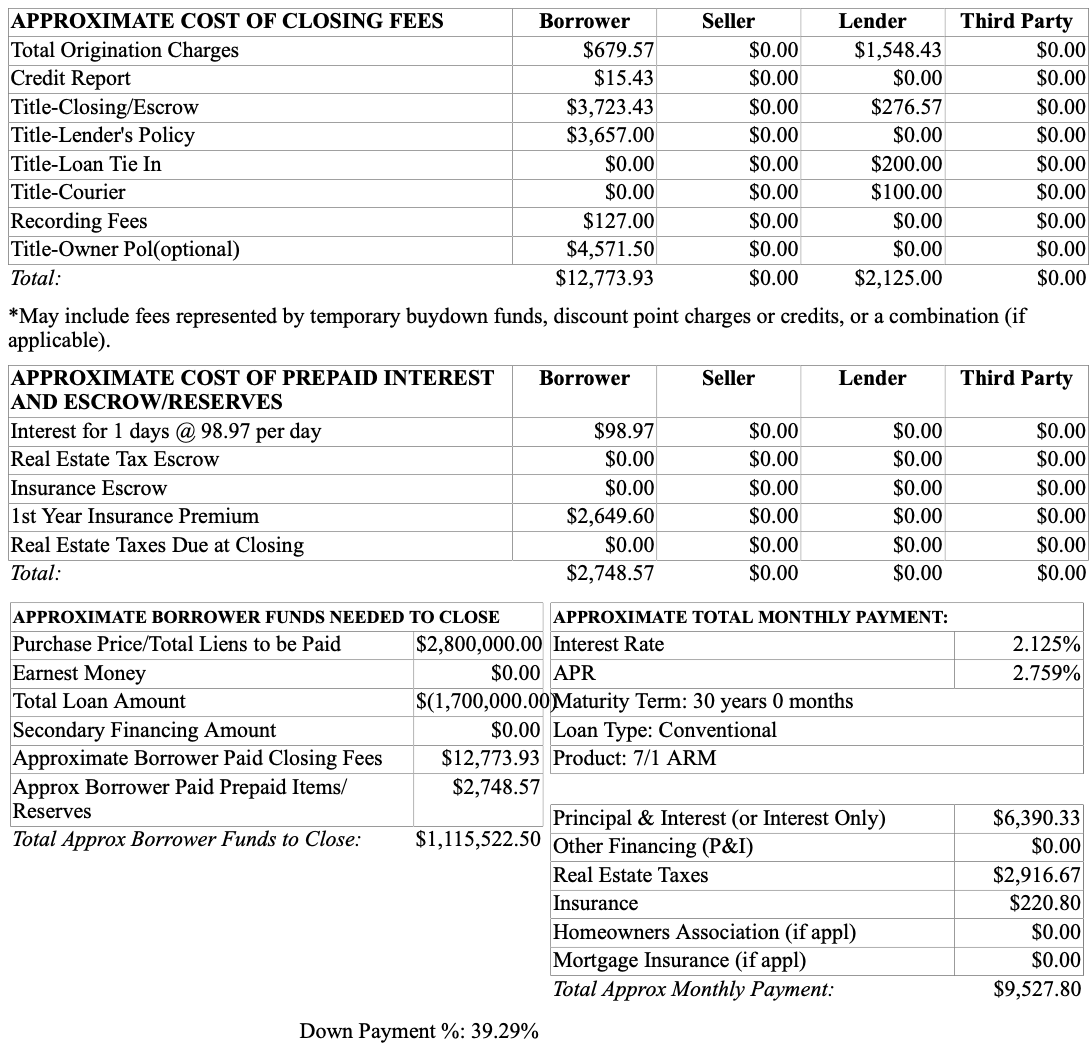

Lender’s title insurance protects the lender from loss if you lose your home to a title claim. Unlike with other types of insurance, you only need to pay for lender’s title insurance once at closing. At closing, your lender might require you to put a few months’ worth of expenses into an escrow account. Although the number of months depends on your lender, many buyers put down 2 months’ worth of expenses at closing.

Year Refinance Interest Rates

Unfortunately, these settlement costs remain a mystery to most homebuyers, especially those dipping their toes into this venture for the first time. Unsurprisingly, buyers have handed over thousands of cash without knowing what they are paying for. A solid credit score isn’t a guarantee that you’ll get your refinance approved or score the lowest rate, but it could make your path easier. Lenders are also more likely to approve you if you don’t have excessive monthly debt. You also should keep an eye on mortgage rates for various loan terms. They fluctuate frequently, and loans that need to be paid off sooner tend to charge lower interest rates.

Closing Costs for BUYERS in California

But with large acres of land to work with in California, your lender may ask you to hire a surveyor to define property lines and confirm your property’s boundaries. If you don’t know what is best in your situation, seek out a tax advisor who can guide you in the right direction. “Closing costs ultimately amount to double if not triple of what you were originally budgeting for,” said Courtney Northrop, who bought a North Hollywood bungalow in January with her wife.

How can I estimate my closing costs?

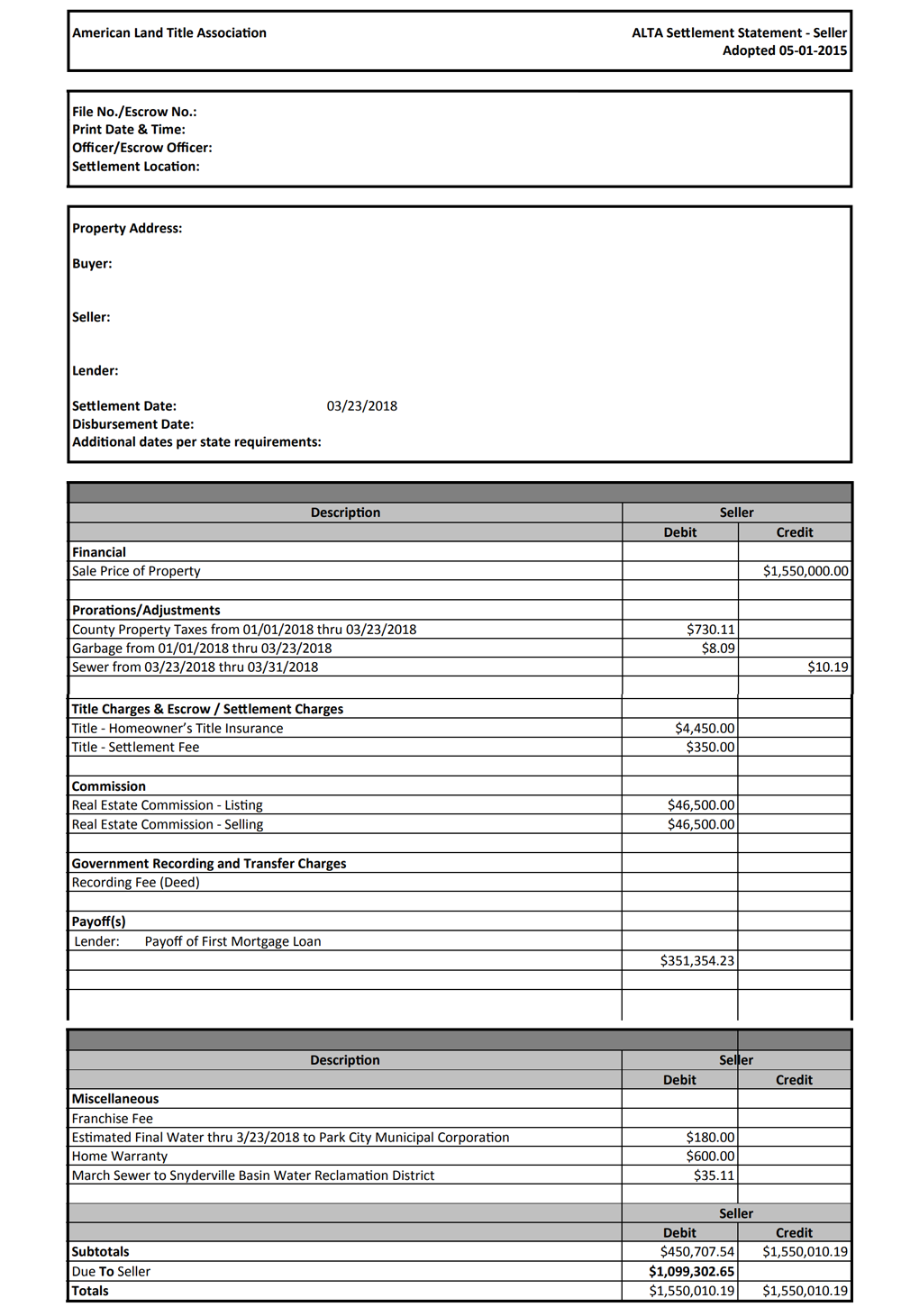

The lender must provide a closing disclosure at least 3 business days before the scheduled closing or settlement. Yesterday, Anglo’s shares surged 16% and closed slightly higher than BHP’s offer (which is worth £25.08 per share). That implies the City expected the initial proposal to be rebuffed. The escrow closes after the seller and buyer fulfill all the conditions outlined in the escrow account and deposit all the funds.

Depending on the location, the transfer tax may be paid by either the buyer or the seller. However, local customs of a specific geographical real estate market may determine who pays. This is a required fee paid to a professional home appraisal company to assess the home’s fair market value used to determine your loan-to-value (LTV) ratio.

But being self- employed doe have its setbacks, and for me this was one of them. Roy not only got the load approved, but I close on my house only 2 weeks after my initial conversation with Roy. I look forward to working with them again next year for my refinance. I had the best experience of my life with RK Mortgage Group.

Property taxes

What Are Average Mortgage Closing Costs for Buyers? - Business Insider

What Are Average Mortgage Closing Costs for Buyers?.

Posted: Wed, 12 Jul 2023 07:00:00 GMT [source]

We explored our comprehensive test plan database, which covers a broad spectrum of scenarios, to tailor our sampling and execution calculators for accuracy. By enhancing and focusing the test plans, we maximized tester efficiency through streamlined processes and time-saving shortcuts. The solution’s built-in flexibility allowed for adaptation in response to regulatory and investor requirement updates. Sign up for CNBC's new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Check out our mortgage refinance calculator to help you decide if this is a good time to refinance. The average rate for refinancing a 30-year fixed mortgage is currently 7.77%, according to Curinos.

Roll closing costs into the loan

Your loan origination fees cover the cost of processing and underwriting your loan. These fees go to your lender in exchange for underwriting your loan and generating your loan paperwork. You can expect to pay about 1% of your loan’s value in origination fees. In some states, you can’t close on a home loan without an attorney. Attorney fees cover the cost of having a real estate attorney coordinate your closing and draw up paperwork for your title transfer.

Realtor rules just changed dramatically. Here’s what buyers and sellers can expect

The amount of the funding fee depends on your military service classification and loan amount. FHA loans require an upfront mortgage insurance premium (UPMIP) of 1.75% of the base loan amount to be paid at closing (or it can be rolled into your mortgage). There’s also an annual MIP payment paid monthly that can range between 0.45% and 1.05%, depending on your loan’s term and base amount. Inspections are done to check the state of a property before the lender issues a loan.

Expect to spend about 0.5 to one percent of your loan amount on these fees. In May 2021, the average home in Southern California had a price tag of $752,250, which means a loan origination fee fell between $3,761 and $7,522. California closing costs in the first half of 2021 averaged $8,219 (or $5,773 not counting taxes), according to real estate data company ClosingCorp. That’s the ninth-highest average in the country and $1,382 more than the national average. Navigating the world of home buying or selling is complicated, especially when it comes to closing costs. But a qualified real estate professional will give you confidence at every step of the home process.

In addition, mortgage closing costs are often a smaller percentage on a refinance loan because some fees— like transfer taxes and owners title insurance — aren’t included. Property taxes are a fixed percentage based on the tax assessor’s appraised value of your home that you pay to the county in which the home is located. The specific percentage varies dramatically from county to county in every part of the country. You pay this tax annually, semiannually or as part of your monthly mortgage payments (escrow).

The good news in Los Angeles, compared to other counties, is that it is customary for the person selling a home to pay for the buyer’s title policy. This is a nice savings for buyers relative to other areas of California. So, you’ll only have to pay for the loan title policy out of pocket. There are additional property taxes, also known as special assessments, that are attached to your property.

No comments:

Post a Comment